History

Aether is considered an NFT that is backed by historical significance. This is because, it is one of the very first meta-verse NFT projects on Ethereum based on ERC-721.

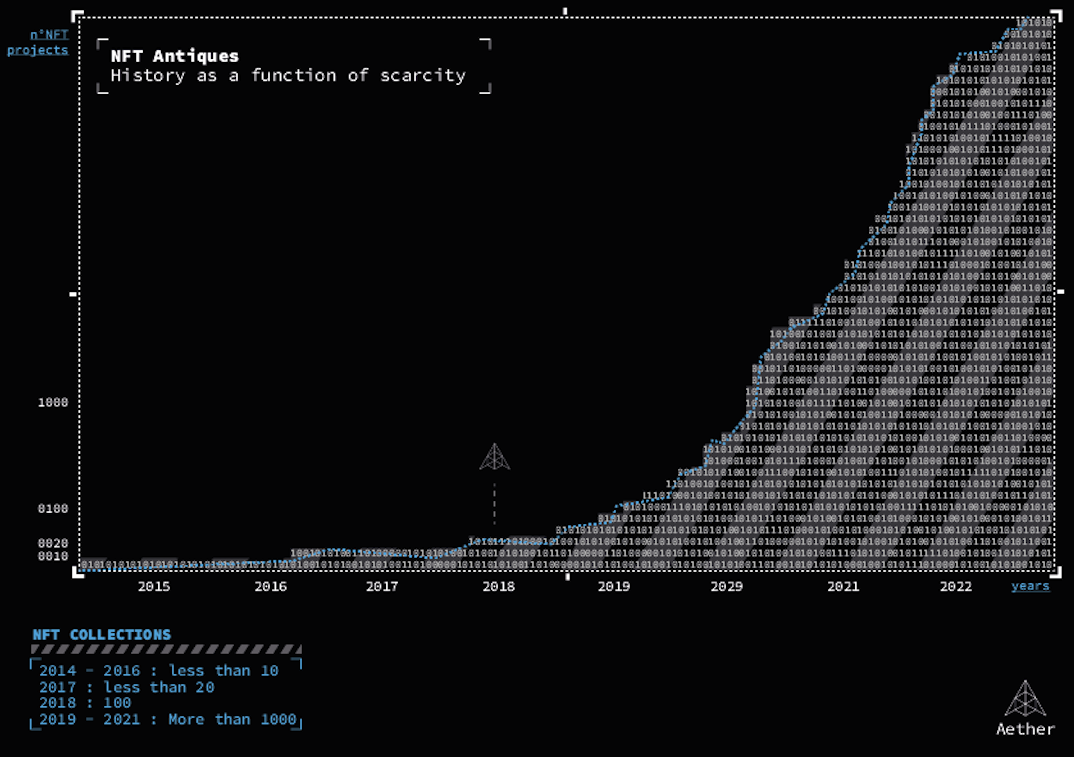

Scarcity

Using history as a function for scarcity we are able define the most under-owned NFT asset class. This document will discuss the value of NFT projects prior to 2021.

Under current trends, 10,000 PFP collections like Cryptopunks and BAYC are leading the market. The widespread popularity of these asset classes ends up being inversely proportional to its future return potential. Once something becomes well known, the price rises significantly as supply is cut, driving the floor up. The lesson is clear. Search out the most under-owned asset class and buy it with conviction. If you can patiently wait until it becomes popular, you will assuredly be rewarded with above average returns. Now comes the question. What are NFT's most under-owned asset class today? In other words, which asset class is not only unpopular but also has a weak distribution, with most people having no significant investment position. The answer to this question is obvious.

Investment grade historically significant NFT antiques are the clear winner here due to the low supply count. Today, high quality historically significant NFT antiques are primarily owned by a select group of connoisseurs and collectors. These investors may only spend a few hundred dollars on a single item. But they use their knowledge of the field to pick out the very best antiques. These discerning antique NFT aficionados are building important collections bit by bit that, one day, will undoubtedly be worth large sums of money as the asset class becomes more popular.

NFT antiques are currently a grossly under-owned asset class destined for a high future rate of return. Truth be told, it isn't too late to get your share.